"You must be a Marxist!"

|

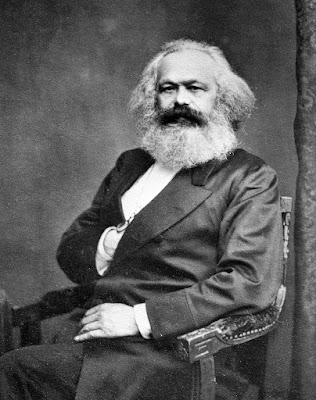

| Karl Marx |

The picture of socialism/communism he paints is often vague. Marx seemed completely okay with "socialists" implying that Europeans/Westerners are civilized while non-Europeans are barbarians.

' The Central Committee of the German Social-Democratic Workmen’s Party issued, on September 5, a manifesto, energetically insisting upon these guarantees.

“We,” they say, “protest against the annexation of Alsace and Lorraine. And we are conscious of speaking in the name of the German working class. In the common interest of France and Germany, in the interest of western civilization against eastern barbarism, the German workmen will not patiently tolerate the annexation of Alsace and Lorraine.... We shall faithfully stand by our fellow workmen in all countries for the common international cause of the proletariat!” ' 2

This creates disunity between level-2 humans/earthlings. Marx talked about a global revolution for all workers, yet is okay with the depiction of non-Europeans as savages. This is dangerous because when one looks at the people who comprise level-2 Trivia, you see level-2 bottom-feeders from many different backgrounds working together against level-2 humans.3

Additionally, in the very first chapter of Das Kapital (1867), Marx asserts that the price of a product depends on the average labour time invested into creating or extracting that product.4

Let's take a hypothetical scenario where the average labour time to mine fool's gold and real gold is the same. A gram of fool's gold in that scenario would still not sell for the same price as a gram of real gold because the properties of real gold make it more useful. Marx displays a poor understanding of how prices are generated.

This still doesn't mean Lenin, Stalin, or other dictators had any intention of implementing real Marxism which would require at least genuine democracy and genuine worker ownership of the means of production. People like Lenin and Stalin just took the parts of Marxism that sounded nice and twisted them around to serve their own sinister agendas.

Level-1 capitalism with a level-1 basic income is the sanest and most practical solution to level-1 wealth and level-1 income inequality right now which is why level-2 bottom-feeders hate the idea so much.5

May 5, 2018: I said before that I support the negative income tax method of providing a basic income. I'm still okay with it, but the negative income tax method could lead to fraud where people earning less than the basic income are just topped-up. This results in lower productivity because additional work will not always result in additional income with a top-up method. A basic income cheque universally provided to every level-1 Homo sapien is more secure for preventing this type of fraud.1

Thus, in theory, a negative income tax would be more efficient, but, in practice, a UBI cheque is the most practical.

May 18, 2018: Whether or not technological advancement creates more jobs or fewer jobs doesn't matter. All jobs should be automated as much as possible. A lot of people get used to a job and don't want the job to be automated. Basic income encourages as much automation as possible because even in a scenario where a person feels they won't be able to find a new job if their current job gets automated, they know they will at least have a basic income. Additionally, it takes time to find a new job and training for a new job is not always paid. A basic income ensures people have an income during transition periods between jobs which again gives people more incentive to allow automation. Thus, those who love technological advancement should support basic income.

Oct. 25, 2018 addition:

Noam Chomsky was kind enough to take a quick look at "Basic Income Economics (Parts 1 and 2)."1 He had no complaints.

|

| https://i.imgur.com/ZHpQA4C.png |

Nov. 2018 addition: The basic income amount wouldn't be taxed or go to creditors, obviously.L1

Jun. 18, 2019:

"From the nature of their situation, too, the servants must be more disposed to support with rigorous severity their own interest against that of the country which they govern than their masters can be to support theirs. The country belongs to their masters, who cannot avoid having some regard for the interest of what belongs to them. But it does not belong to the servants. The real interest of their masters, if they were capable of understanding it, is the same with that of the country, and it is from ignorance chiefly, and the meanness of mercantile prejudice, that they ever oppress it. But the real interest of the servants is by no means the same with that of the country, and the most perfect information would not necessarily put an end to their oppressions. The regulations accordingly which have been sent out from Europe, though they have been frequently weak, have upon most occasions been well-meaning. More intelligence and perhaps less good-meaning has sometimes appeared in those established by the servants in India. It is a very singular government in which every member of the administration wishes to get out of the country, and consequently to have done with the government as soon as he can, and to whose interest, the day after he has left it and carried his whole fortune with him, it is perfectly indifferent though the whole country was swallowed up by an earthquake."

-Adam Smith, The Wealth of Nations (1776, book 4 chapter 7)7

Adam Smith is a bottom-feederL2 and is markedL2 (meaning individuals in his personality channel are markedL2).

Jul. 1, 2019:

(L1:) Black slaves were treated well by their masters but not taxed enough, according to Smith:

"In America and the West Indies the white people even of the lowest rank are in much better circumstances than those of the same rank in England, and their consumption of all the luxuries in which they usually indulge themselves is probably much greater. The blacks, indeed, who make the greater part of the inhabitants both of the southern colonies upon the continent and of the West India islands, as they are in a state of slavery, are, no doubt, in a worse condition than the poorest people either in Scotland or Ireland. We must not, however, upon that account, imagine that they are worse fed, or that their consumption of articles which might be subjected to moderate duties is less than that even of the lower ranks of people in England. In order that they may work well, it is the interest of their master that they should be fed well and kept in good heart in the same manner as it is his interest that his working cattle should be so. The blacks accordingly have almost everywhere their allowance of rum and molasses or spruce beer in the same manner as the white servants, and this allowance would not probably be withdrawn though those articles should be subjected to moderate duties."

-Adam Smith, The Wealth of Nations (1776, book 5 chapter 3)7

Oct. 24, 2019:

Basic incomeL1 should always be adjusted to compensate for inflation.

16 Mar 2020:

"One of the most striking lessons of the Forbes rankings is that, past a certain threshold, all large fortunes, whether inherited or entrepreneurial in origin, grow at extremely high rates, regardless of whether the owner of the fortune works or not. To be sure, one should be careful not to overestimate the precision of the conclusions one can draw from these data, which are based on a small number of observations and collected in a somewhat careless and piecemeal fashion. The fact is nevertheless interesting. Take a particularly clear example at the very top of the global wealth hierarchy. Between 1990 and 2010, the fortune of Bill Gates—the founder of Microsoft, the world leader in operating systems, and the very incarnation of entrepreneurial wealth and number one in the Forbes rankings for more than ten years—increased from $4 billion to $50 billion. At the same time, the fortune of Liliane Bettencourt—the heiress of L’Oréal, the world leader in cosmetics, founded by her father Eugène Schueller, who in 1907 invented a range of hair dyes that were destined to do well in a way reminiscent of César Birotteau’s success with perfume a century earlier—increased from $2 billion to $25 billion, again according to Forbes. Both fortunes thus grew at an annual rate of more than 13 percent from 1990 to 2010, equivalent to a real return on capital of 10 or 11 percent after correcting for inflation.

In other words, Liliane Bettencourt, who never worked a day in her life, saw her fortune grow exactly as fast as that of Bill Gates, the high-tech pioneer, whose wealth has incidentally continued to grow just as rapidly since he stopped working. Once a fortune is established, the capital grows according to a dynamic of its own, and it can continue to grow at a rapid pace for decades simply because of its size." 8

"The conclusion is obvious: the net asset position of the rich countries relative to the rest of the world is in fact positive (the rich countries own on average more than the poor countries and not vice versa, which ultimately is not very surprising), but this is masked by the fact that the wealthiest residents of the rich countries are hiding some of their assets in tax havens."8

"To be sure, good economic and social policy requires more than just a high marginal tax rate on extremely high incomes. By its very nature, such a tax brings in almost nothing. A progressive tax on capital is a more suitable instrument for responding to the challenges of the twenty-first century than a progressive income tax, which was designed for the twentieth century (although the two tools can play complementary roles in the future). For now, however, it is important to dispel a possible misunderstanding." 8

A progressive income tax and a progressive capital tax should be implemented.

21Mar2020:

Alberta's 2006 "prosperity bonus" is an example of a mini-UBI:

"The Alberta government is going to use about $1.4 billion of this year's surplus to give every Albertan a one-time rebate of $400.

Our government believes that individual Albertans can and should decide for themselves what to do with their rebates." 9

UBI does not have to go to prisoners but should still go to people who have been released from prison.L1

"All Albertans who were residents of the province as of September 1 and filed a 2004 tax return with the Canada Revenue Agency received the bonus, except for prisoners, who did not qualify. Cheques for Albertans under 18 years of age were payable only to their primary caregiver (the mother in most cases), thus leaving parents to determine how their children's share was to be distributed or used.[2] Homeless Albertans also qualified—the government pledged to work with inner-city agencies to ensure that the homeless receive their money."10

25Mar2020:

UBI should not be funded by just printing more money which causes damaging inflation.L1

15Apr2020:

Piketty is shamelessly lying:

"The solution to the problem of capital suggested by Karl Marx and many other socialist writers in the nineteenth century and put into practice in the Soviet Union and elsewhere in the twentieth century was far more radical and, if nothing else, more logically consistent." 8

1. "Basic Income Economics (Parts 1 and 2)." https://panoramicsbook.blogspot.com/p/part-1-1-material-universe-is.html.

2. Marx, Karl. "The Second Address." 9 Sep. 1870, The Civil War in France, https://www.marxists.org/archive/marx/works/1871/civil-war-france/ch02.htm.

3. "Hecate." http://pan0ramics.blogspot.ca/2018/04/hecate.html.

4. Marx, Karl. Das Kapital. Hamburg, 1867, https://www.marxists.org/archive/marx/works/1867-c1/ch01.htm.

5. "Basic Income Economics (Parts 3 and 4)." http://en.minguo.info/book/panoramics/basic_income_economics_parts_3_and_4.

6. Note: All the labels for my blog posts are level-1 terms. Thus, the label "capitalism" refers to level-1 capitalism, not level-1 Dorianism.

7. Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations. 1776, https://en.wikisource.org/wiki/The_Wealth_of_Nations/Book_IV/Chapter_7.

8. Piketty, Thomas. Capital in the Twenty-First Century. The Belknap Press of Harvard University Press, 2014.

9. Klein, Ralph. "Alberta's Surplus." Office of the Premier - Government of Alberta. Archived from the original on 29 Oct. 2005. https://web.archive.org/web/20051029061826/http://www.gov.ab.ca/premier/surplus.cfm.

10. "Prosperity Bonus." Wikipedia, https://en.wikipedia.org/wiki/Prosperity_Bonus.

Comments

Post a Comment